by

Judyta Malinowska

Retail Products Department

Few of us set a good example for our kids when it comes to dealing with money, as the “Poles’ attitudes towards saving” survey prepared by the Kronenberg Foundation.

And it is a pity, as far quicker than at school, the youth learn by observing and imitating the way their parents behave. It is worth providing kids with practical financial competencies already from an early age, in order to bring them up to become adults who are well-acquainted with the world of money.

Start discussing money.

Finances are not only the domain of adults – familiarizing kids with them from an early age is a good habit. However, as many as a half of us (49%, “Poles’ Attitudes Towards Saving” survey prepared by the Kronenberg Foundation at Citi Handlowy) do not include their kids in discussions about money. Frequently, kids neither know where adults take money from, nor are they aware of its relative value. It is good to talk – for example about what fixed costs are, or explain to them the value of one hour of our work. Consequently, a child can assess how much effort a new phone model will cost us.

Finances are not only the domain of adults – familiarizing kids with them from an early age is a good habit. However, as many as a half of us (49%, “Poles’ Attitudes Towards Saving” survey prepared by the Kronenberg Foundation at Citi Handlowy) do not include their kids in discussions about money. Frequently, kids neither know where adults take money from, nor are they aware of its relative value. It is good to talk – for example about what fixed costs are, or explain to them the value of one hour of our work. Consequently, a child can assess how much effort a new phone model will cost us.

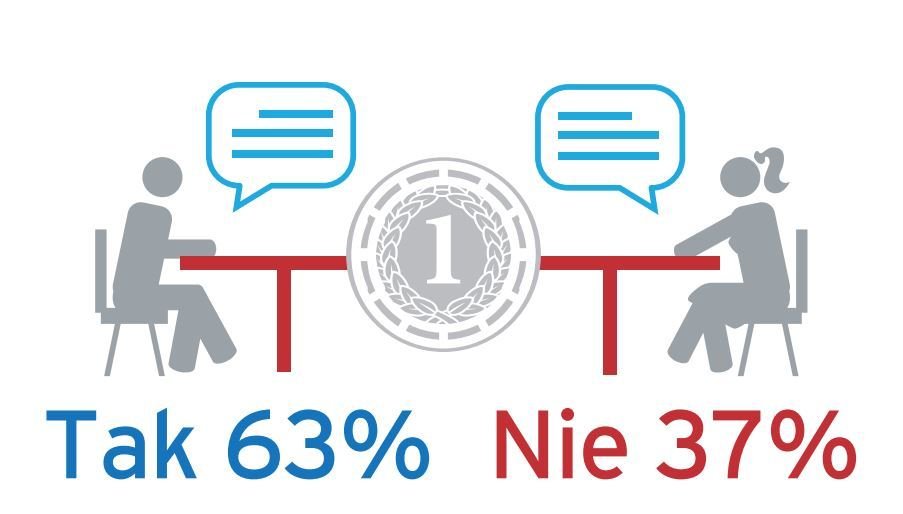

Do you discuss financial matters with other household members (budget, saving money, investments)?

Focus on independence

65% of parents do not give their children regular pocket money. Meanwhile, managing your own budget is the best lesson of finances. It is crucial that a child can make their own decisions concerning what they will spend the accumulated money on – thus they will understand that funds are not unlimited and learn to set priorities. It is worthwhile to acquire the basic knowledge on banknotes and coins, in order to be more skilled in controlling the virtual money in the future, presented in the form of numbers on our account.

65% of parents do not give their children regular pocket money. Meanwhile, managing your own budget is the best lesson of finances. It is crucial that a child can make their own decisions concerning what they will spend the accumulated money on – thus they will understand that funds are not unlimited and learn to set priorities. It is worthwhile to acquire the basic knowledge on banknotes and coins, in order to be more skilled in controlling the virtual money in the future, presented in the form of numbers on our account.

Teach them saving

Fewer than 20 percent of parents encourage their kids to save money. Hence, no wonder that most adults in Poland face problems with saving – according to the surveys of the Kronenberg Foundation only 16% of us save on a regular basis. Saving is a useful habit which is worth instilling in our children. Parent’s support can serve as motivation, for example, a declaration of providing the child with the remaining amount if the child saves a part of the money for a desired thing, or will collect small change after doing shopping. It is worth pointing out that saving also translates into concrete behaviors. Let’s show our child that if it turns off the light in rooms or switches off the computer, this will contribute to lower electricity bills, and the saved money can be spent on something extra.

Plan the budget together with the child

Surveys show that only 19% of us involve kids in planning household expenses. The concept of budget as a difference between the amount we put in to family finances and how much we spend can be clear already for the youngest. The budget for family pleasures or holidays will equal to what is left after covering the fixed costs. An exercise we can do with our child is planning the budget for its birthday. A child has PLN 100 for this purpose. We list the most crucial products – the indicated items will exceed the planned costs for sure. A child needs to decide what it can give up and what it can replace with a cheaper equivalent. It can also look for a special offer or prepare the product itself.

Let them check the power of gold in practice

It is worth showing kids money in the real life – by comparing prices while doing shopping – only 19% of adults do so. Let’s take them shopping and point out the prices of similar products and the size of packagings. They should remember to take bags from home with them – we will not have to pay for plastic bags in shops and the value of the savings may amount to the cost of an additional box of cookies in the trolley (let’s mention the ecological aspect as well). We should point out that we use discount cards at stores or discounts assigned to our card. It is worth allowing children to decide on their finances themselves – let them choose what they will spend money on. A teenager can also get their first bank account.

Fewer than 20 percent of parents encourage their kids to save money. Hence, no wonder that most adults in Poland face problems with saving – according to the surveys of the Kronenberg Foundation only 16% of us save on a regular basis. Saving is a useful habit which is worth instilling in our children. Parent’s support can serve as motivation, for example, a declaration of providing the child with the remaining amount if the child saves a part of the money for a desired thing, or will collect small change after doing shopping. It is worth pointing out that saving also translates into concrete behaviors. Let’s show our child that if it turns off the light in rooms or switches off the computer, this will contribute to lower electricity bills, and the saved money can be spent on something extra.

Plan the budget together with the child

Surveys show that only 19% of us involve kids in planning household expenses. The concept of budget as a difference between the amount we put in to family finances and how much we spend can be clear already for the youngest. The budget for family pleasures or holidays will equal to what is left after covering the fixed costs. An exercise we can do with our child is planning the budget for its birthday. A child has PLN 100 for this purpose. We list the most crucial products – the indicated items will exceed the planned costs for sure. A child needs to decide what it can give up and what it can replace with a cheaper equivalent. It can also look for a special offer or prepare the product itself.

Let them check the power of gold in practice

It is worth showing kids money in the real life – by comparing prices while doing shopping – only 19% of adults do so. Let’s take them shopping and point out the prices of similar products and the size of packagings. They should remember to take bags from home with them – we will not have to pay for plastic bags in shops and the value of the savings may amount to the cost of an additional box of cookies in the trolley (let’s mention the ecological aspect as well). We should point out that we use discount cards at stores or discounts assigned to our card. It is worth allowing children to decide on their finances themselves – let them choose what they will spend money on. A teenager can also get their first bank account.